In the digital world credit card fraud has become a pervasive threat. It has become an indispensable part of our daily lives.

Card skimming is a growing, alarming, and insidious tool in the fraudster’s arsenal. As we enter 2025, financial crimes continuously evolve in financial institutions.

This fraud is leaving them vulnerable to Americans as silent predators.

In the past year, 62 million Americans have been victims of fraudulent charges on their credit or debit cards. Annually, the unauthorized purchases of credit cards exceed $6.2 billion.

Moreover, this is a more alarming situation that 63% of U.S. credit card holders have experienced fraud at least once. Some of them are victims of this crime multiple times.

These startling statistics draw a picture of the current need for credit card security.

The threat is not only prevailing in the United States. This has become a concern in the global financial market.

Credit card fraud and losses are projected to reach a staggering $43 billion by 2026. 92% of unauthorized transactions occur without a physical card or being stolen.

This percentage highlights the stagy methods harnessed by modern fraudsters. Most of the fraudsters use skimmers for credit card theft.

With the rise of technology criminals and fraudsters have evolved their methods and tactics of theft. As we delve deeper you’ll know credit card skimmers are one of the most prevalent and dangerous threats.

we’ll explore what credit card skimmers are, how they work, and how you can protect yourself from this theft using different tools like credit card skimmer detectors along with other preventive measures.

What Is A Credit Card Skimmer?

A credit card skimmer is a small device that’s sometimes installed illegally. Card skimming is a category of credit card fraud. It involves illegally collecting a victim’s debit or credit card information.

Criminals attach to legitimate card readers at ATMs, gas stations, or point-of-sale (POS)terminals even parking meters. You also use cards when self-service checkout, or making online purchases.

When customers swipe their credit or debit cards the skimmer captures your credit card number, expiration date, and other personal information.

These devices are often hard to detect and can scan or skim card information. Skimmers are blended seamlessly with the original machine. a skimmer captures the data from the magnetic stripe of your card illegally.

when you swipe or insert a card the malefactor acts as a man-in-the-middle for capturing card information. Some advanced skimmers, known as “shimmers. Shimmers also target chip-enabled cards resulting in credit card theft activities.

Some skimmers use Bluetooth devices to steal card information. stolen credit or debit card information can then be sent to any individual on their devices like a computer or phone.

The skimming devices are so small in size and people don’t notice them. The money stolen can be used to make further purchases without victims knowing.

How Do Credit Card Skimmers Work?

The data of a credit card can be stolen via the card’s magnetic strip when a card gets skimmed. Skimmers extract information like cardholder name, card number, and expiration date.

This information gets copied on skimmers and fraudsters use it for different activities. In the step breakdown, you’ll know how these skimmers work.

Installation

Criminals connect skimmers to a legitimate card reader. They attach these skimmers to different places including payment terminals.

Data Capturing

When you swipe your card skimmers steal the data from the magnetic stripe of your card.

Data Transmission

Few skimmers store data locally while others transfer the data using wireless transmission methods in real-time.

Usage Of Data

Criminals use the data for different illegal purposes

- They make unauthorized purchases both online or over the phone

- They can sell the data to other scammers for a profit

- They can use data for identity theft

- Create counterfeit cards

Types Of Skimming Attacks

Skimming attacks are one of the cybercrimes. Using different skimming techniques and tools.

They capture sensitive financial data and information on credit cards and debit cards. Skimming attacks include different types.

Electronic Skimming

Electronic or E- e-skimming is an advanced form of skimming. It commonly infects e-commerce websites.

Websites with malicious code steal customer card information during online transactions. This skimming theft is difficult to detect and it doesn’t need any physical tampering.

Traditional Card Skimming

Physical card skimming is one of the traditional methods. This method uses electronic devices called skimmers or “shimmers” to capture credit card information.

They can be installed in different places like ATMs and gas station credit card scanners. They often use hidden cameras and sensors.

Hand-held Point-Of-Sale (POS) Skimming Systems

In this method, small, concealed skimming devices are used to harvest the information.

The information stored on the magnetic stripe during transactions gets stolen. It is often carried out by the employees in an organization.

POS Swaps

When criminals replace the original device with POS devices and collect the data of a credit card this theft is known as a POS Swap.

Criminals tamp with existing devices instead of installing skimming devices.

Self-Service Skimming

This type of skimming theft happens at self-service locations. Self-service locations incluses ATMs and gass stations.

Criminals install skimming devices on the payment terminals to steal the data from credit cards.

Digital Skimming

Digital skimming, web skimming, or Magecart attack, involves injecting malicious code into websites. Then this code extracts the payment information from online forms.

Deep Insert Skimming

This is an emerging threat. These are wafer-thin devices that are hidden inside ATMs, making them extremely difficult to detect

The Growing Threat Of Credit Card Skimming

According to The Federal Bureau of Investigation (FBI), it is estimated that credit card skimming involves over $1 billion in losses for both consumers and financial institutions annually. Criminals are finding more ways to exploit vulnerabilities with the advancement in technology.

- Fraud losses have increased from previous years. The fraud losses increased from $5.8 billion which is a total increase of 70%

- In New York credit card skimmer caught resulted in the steal of over $500,000 from unsuspecting victims.

The growing threats of losses and the increasing percentage of card skimmers and scams highlight the need for vigilance.

Common Locations For Skimmers

| Location | Risk Level |

| ATMs | High |

| Gas Stations | High |

| Retail Terminals | Moderate |

| Tourist Areas | Very High |

How To Detect A Credit Card Skimmer

It is challenging to detect credit card skimming devices but not impossible. There are various ways to detect skimming devices to protect your cards against illegal activities and fraudster attacks.

protect yourself from skimmer credit card scams by following the steps below. The ways to detect credit card skimmers include

Inspect The Card Reader

Before you put your card in look for any unusual attachments. If it is loose from parts use another one. Card readers are attached to where you swipe your card in the slot.

Compare Readers

With the availability of different payment terminals compare all. They can be at any place for example gas stations.

Check Security Seals

If the security seals are broken at any place then avoid using that payment terminal.

Wiggle The Reader

A wobbly reader or loose devices indicate the installation of skimmers.

Use A Credit Card Skimmer Detector

Handheld scanning devices can detect skimmers. Bluetooth-enabled devices can be a great help to detect skimmers nearby.

Keep An Eye On Your Statements

Regularly check your statements. If you see any purchases you didn’t make or any suspicious activity. Report this activity immediately.

Hide Your Pin

When you enter your PIN, Hide it with your hand. A sneaky camera can capture your pin. Don’t allow others to see your secret code.

Also Read: What Is Clone Cards? Definition, Examples, And Ways To Protect Yourself

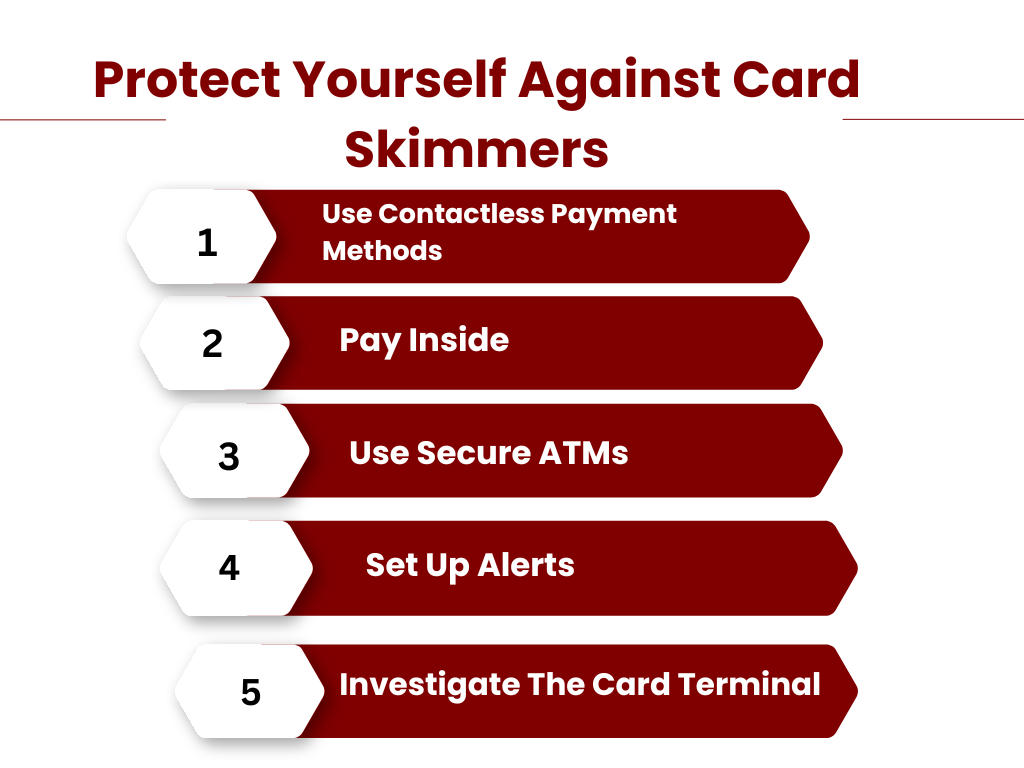

Protect Yourself Against Card Skimmers

Preventing yourself from credit card skimmers requires vigilance. vigilance and adopting safer payment habits requires a combination of awareness and proactive measures.

Actionable steps can keep your card information safe and enhance your credit card skimmer protection.

Use Contactless Payment Methods

Contactless payment methods, Tap-to-pay technology, and digital wallets are more secure. These methods include Apple Pay or Google Pay.

They are less susceptible to skimming because they don’t require physical contact or to insert your card into a reader.

Pay Inside

Gas pumps or gas stations are high-risk locations and a common target for skimmers.

To reduce your risk opt to pay inside the gas station instead of at the pump terminals.

Use Secure ATMs

Choose ATMs located inside banks or use Chip-enabled cards. They are more secure than magnetic stripe cards.

Avoid areas with security cameras. Use a unique transaction code for each purchase. Avoid using ATMs in convenience stores or tourist areas.

Set Up Alerts

Set up alerts when any purchase seems suspicious. Many card issuers enable this feature. They can help you to monitor activities.

They can keep a record of when someone uses your card without your knowledge.

Investigate The Card Terminal

Use credit card scanner tools to investigate the card terminals. These credit card skimmer scanners are often used by travelers.

Final Thoughts

Credit card skimmers are growing With fraud losses exceeding $5.8 billion in 2021, be vigilant when using ATMs or gas pumps. This threat can have serious financial consequences.

knowledge and proactive approach can significantly reduce your risk of falling victim. To protect yourself from skimmers invest in a credit card skimmer detector. consider using more secure payment by actively managing your finances and staying vigilant.

Chip-enabled cards or contactless payment methods are more secure to use. staying informed is your first line of defense against all criminal activities.

FAQs

What Is A Credit Card Skimmer?

A credit card skimmer is a small device that’s sometimes installed illegally. Card skimming is a category of credit card fraud.

It involves illegally collecting a victim’s debit or credit card information.

How To Spot A Credit Card Skimmer?

Skimmers can be illegally installed at gas pumps, ATMs, Retail Terminals, Tourist Areas, and other locations.

What Does A Credit Card Skimmer Look Like?

A credit card skimmer is a small device that involves illegally collecting a victim’s debit or credit card information.

How Do I Stop My Credit Card From Being Skimmed?

Consider these methods to stop your credit card from being skimmed

- Use Contactless Payment Methods

- Investigate the Card Terminal

- Set Up Alerts

- Use Secure ATMs

- Pay Inside

Related Articles:

+ There are no comments

Add yours